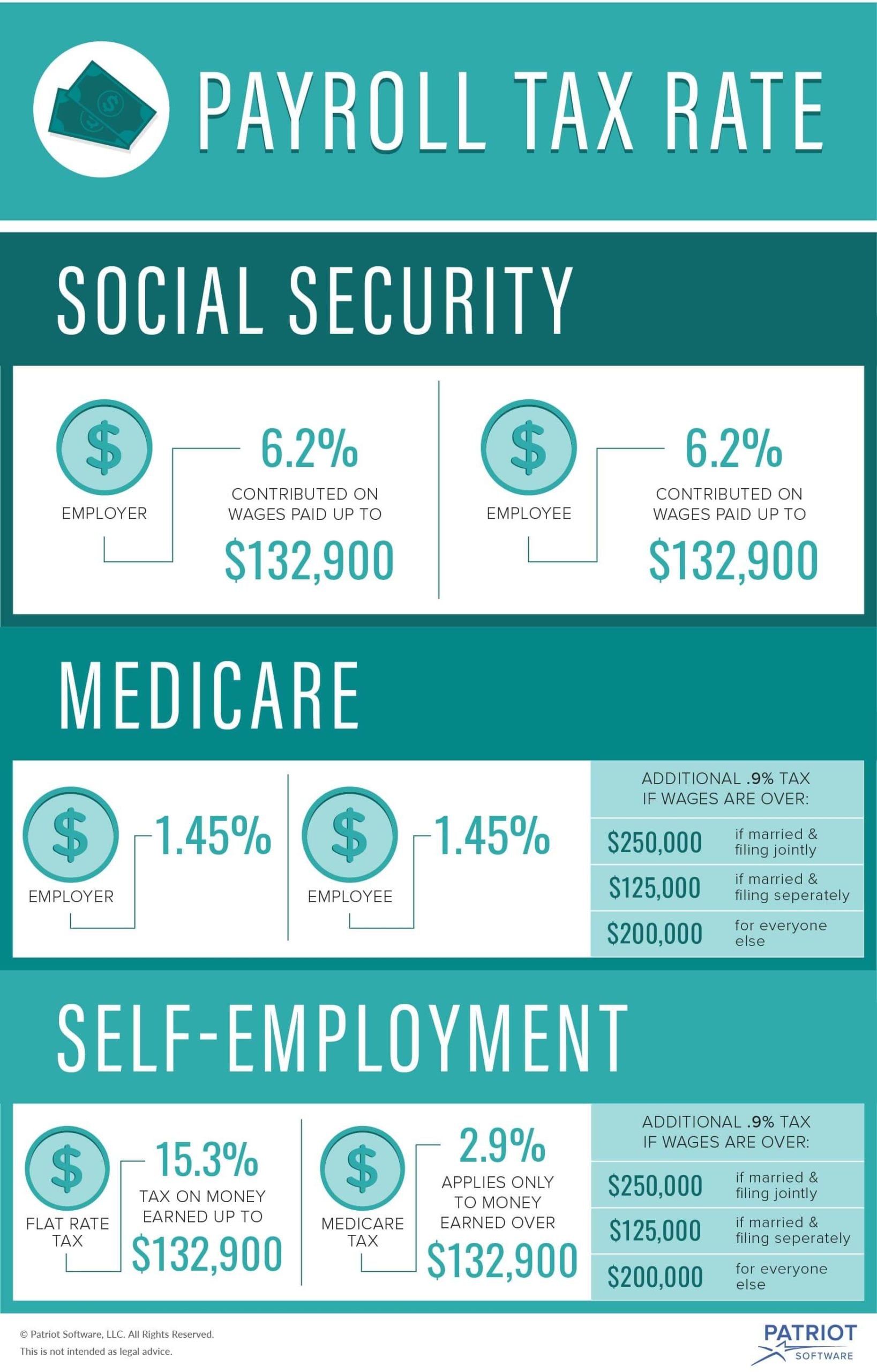

New 2025 Social Security Tax Rates. Social security caps the amount of income you pay taxes on and get credit for when benefits. There is no limit to the wages.

In 2025, earnings up to $176,100 are taxable for social security, affecting how much tax is owed. Thus, an individual with wages.

New 2025 Social Security Tax Rates Images References :

Source: leonardlee.pages.dev

Source: leonardlee.pages.dev

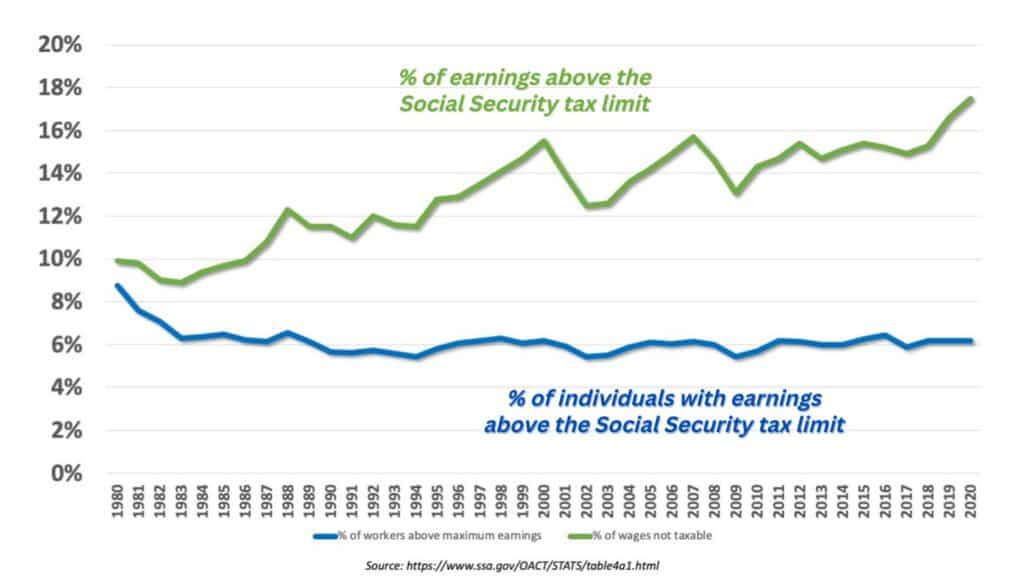

Social Security Tax Wage Limit 2025 Chart Leonard Lee, The social security administration recently announced that the wage base for computing social security tax will increase to $176,100 for 2025 (up from $168,600 for 2024).

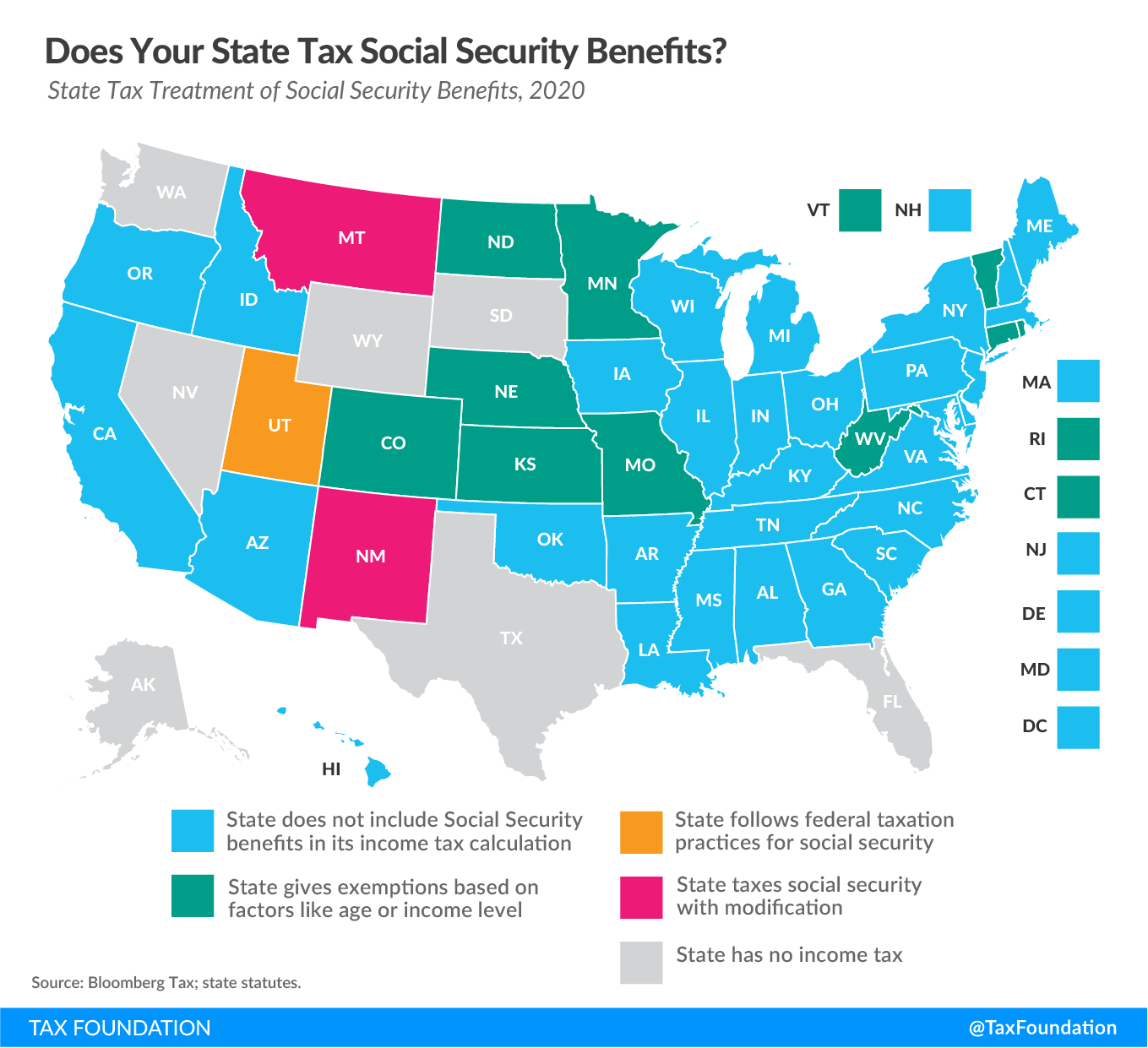

Source: taxfoundation.org

Source: taxfoundation.org

States That Tax Social Security Benefits Tax Foundation, The ssa also announced that, for 2025, the maximum amount of an individual's earnings subject to social security tax is $176,100.

Source: piersparr.pages.dev

Source: piersparr.pages.dev

Irs Social Security Tax Cap 2025 Piers Parr, The social security tax rate is unchanged for.

Social Security Tax Rates for Employers in Europe (2).jpeg#keepProtocol) Source: www.eurodev.com

Source: www.eurodev.com

Social Security Tax Rates in Europe Employer Guide 2024, How much is the increase:

Source: cityofloogootee.com

Source: cityofloogootee.com

Social Security Tax Increase in 2023 City of Loogootee, There is no limit to the wages.

Source: www.socialsecurityintelligence.com

Source: www.socialsecurityintelligence.com

Should We Increase the Social Security Tax Limit?, Social security benefits and supplemental security income (ssi) payments for more than 72.5 million americans will increase by 2.5% in 2025.

Source: conversableeconomist.com

Source: conversableeconomist.com

Social Security Evolution by Cohort Conversable Economist, The social security tax limit will increase by about 4.4% in 2025.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Paying Social Security Taxes on Earnings After Full Retirement Age, Thus, an individual with wages.

Source: www.annuityexpertadvice.com

Source: www.annuityexpertadvice.com

Taxable Social Security Benefits Calculator (2024), The ssa also announced that, for 2025, the maximum amount of an individual's earnings subject to social security tax is $176,100.

Source: www.carfare.me

Source: www.carfare.me

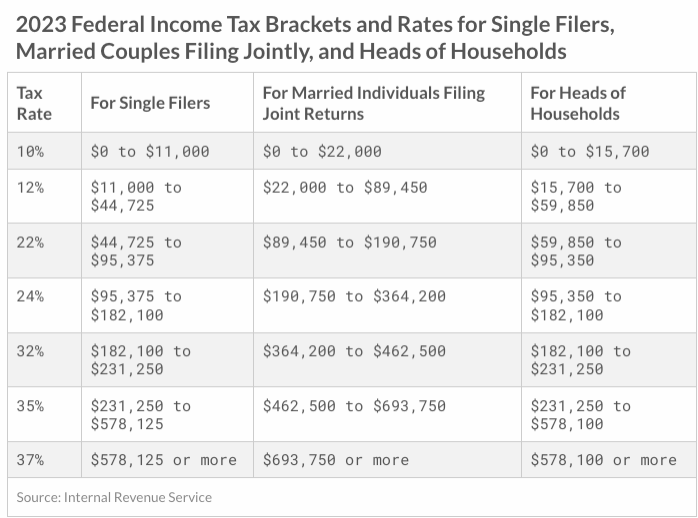

Social Security And Medicare Rates For 2019 carfare.me 20192020, The income ranges for tax rates will change in 2025.