What Is The Tax Rate On Bonuses In 2025. However, employers could instead combine a bonus with your regular wages as though it’s one of your usual paychecks—with your. If your employee’s bonus exceeds $1.

From 1 july 2025, the. You can minimize your tax burden by having your employer withhold taxes from each paycheck above your tax bracket, utilizing all.

These Tax Rates Vary By State.

Australia annual bonus tax calculator 2023, use icalculator™ au to instantly calculate your salary increase in 2023 with the latest australia tax tables.

If Your Employee’s Bonus Exceeds $1.

If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets.

What Is The Tax Rate On Bonuses In 2025 Images References :

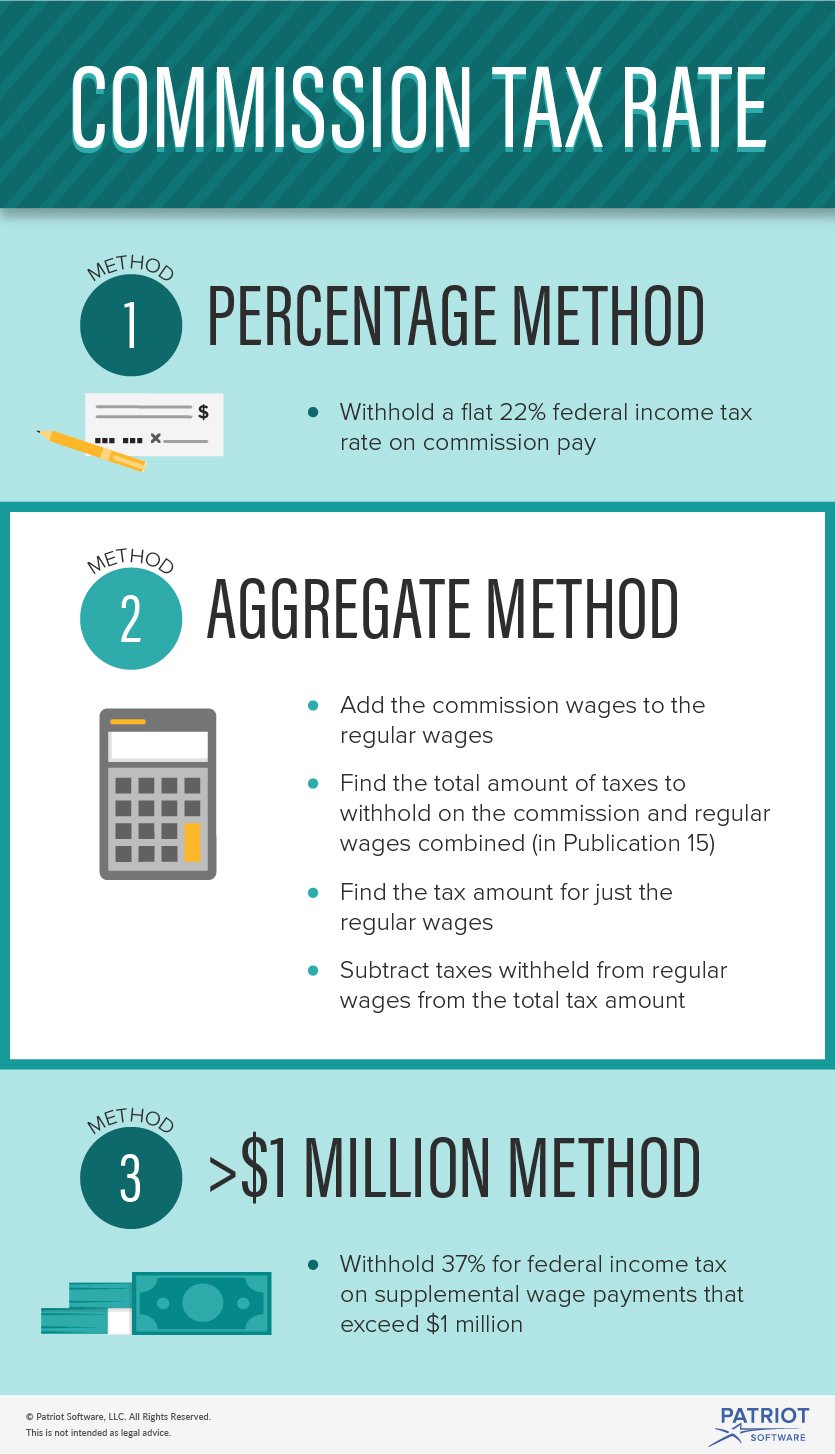

Tax Rate For Bonuses 2025 Dell Ofelia, What you may not know is that the irs considers bonus pay a form of earnings known as supplemental wages, which is subject to a separate tax withholding table than your. If you pay an employee a bonus of more than $1 million, there is a 22% tax rate on the first million dollars and a 37% tax rate on everything above that.

How Much Taxes Are Deducted From A Bonus Tax Walls, On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025. Check out our updated bonus calculator.

Source: businesswalls.blogspot.com

Source: businesswalls.blogspot.com

How Much Can My Business Earn Before I Pay Tax Business Walls, But the irs also considers bonuses to be supplemental wages. If you pay an employee a bonus of more than $1 million, there is a 22% tax rate on the first million dollars and a 37% tax rate on everything above that.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200068 Effective Marginal Tax Rates on Wages, Salaries, and Capital, However, employers could instead combine a bonus with your regular wages as though it’s one of your usual paychecks—with your. Under tax reform, the federal tax rate for withholding on a bonus was lowered to 22%, down from the federal income tax rate of 25%.

Source: www.ramseysolutions.com

Source: www.ramseysolutions.com

How Are Bonuses Taxed? Ramsey, The income tax brackets and rates for australian residents for next financial. But the irs also considers bonuses to be supplemental wages.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200069 Effective Marginal Tax Rates on Wages, Salaries, and Capital, You typically have to pay payroll taxes including the 1.45% medicare tax plus the 6.2% social security tax on the amount of your wages, including. Australia annual bonus tax calculator 2025, use icalculator™ au to instantly calculate your salary increase in 2025 with the latest australia tax tables.

Source: pollymarketa.pages.dev

Source: pollymarketa.pages.dev

When Does Taxes Start 2025 April Brietta, Under tax reform, the federal tax rate for withholding on a bonus was lowered to 22%, down from the federal income tax rate of 25%. A tax withheld calculator that calculates.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2025 year of assessment Just One Lap, But the irs also considers bonuses to be supplemental wages. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every dollar over that gets.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T220078 Average Effective Federal Tax Rates All Tax Units, By, These changes are now law. S corporation shareholders and partners in a partnership could see their effective federal income tax rate increase by 30% by the end of december 31, 2025, due to the.

Source: blog.allgo.ie

Source: blog.allgo.ie

How to Pay Company Bonuses TaxFree, These changes are now law. The bonus tax rate is 22% for bonuses under $1 million.

If Your State Does Not Have A Special.

Use the income tax estimator to work out your tax refund or debt.

The Aggregate Method With The Aggregate Method, Your.

Work out the tax to withhold from payments of salary or wages that include a back payment, commission or bonus.

Category: 2025